In the rapidly evolving financial industry, regulatory compliance has become increasingly critical to ensure market integrity and protect consumers. Supervisory Technology, or SupTech, is emerging as a transformative solution that leverages advanced technology and data analysis to enhance the supervisory capabilities of financial authorities. According to the Cambridge SupTech Lab Report 2023, the development and deployment of SupTech are fundamentally changing how regulatory oversight is conducted, aiming to improve market outcomes and financial stability through more efficient and effective supervision. This blog post provides a comprehensive overview of the current state and future prospects of SupTech, highlighting key trends for regulators and the financial industry as a whole, and how regulated firms can navigate this fast-changing landscape.

Historical Context and Recent Developments

Efforts to digitize financial supervision began in earnest post-1987, following significant market disruptions. Major shifts occurred after the 2008 global financial crisis, prompting the integration of big data analytics and AI into regulatory frameworks. The COVID-19 pandemic further accelerated the adoption of cloud-based platforms and automated compliance tools. Recent developments in 2023 include the introduction of Generative AI (GenAI) and advanced data processing techniques, strategic initiatives such as Singapore’s Project MindForge, and AI-driven regulatory compliance efforts in Abu Dhabi. Additionally, there is a growing focus on cybersecurity with technologies like quantum-safe communication being developed to address emerging threats and ensure impenetrable regulatory frameworks.

Current Trends in SupTech Utilization

The development and implementation of SupTech represent a significant shift in the financial regulatory landscape. Financial authorities are actively operationalizing tools related to regulatory compliance across various domains, including prudential supervision, Anti-Money Laundering (AML), Counter-Financing of Terrorism (CFT), and Environmental, Social, and Governance (ESG) areas. These interconnected trends illustrate a broad and integrated approach to adopting SupTech, highlighting its critical role in modernizing financial supervision and ensuring regulatory compliance. As regulators continue to prioritize and develop SupTech use cases, the financial industry must adapt and embrace these technologies to stay ahead in a rapidly evolving regulatory environment.

Impact on Different Business Sectors

SupTech's applications span multiple areas, each addressing specific regulatory needs. In consumer protection, AI-powered chatbots and complaints management systems enhance consumer interaction and streamline complaint resolutions. Prudential supervision benefits from tools like Athena, which assists in regulatory document analysis. Advanced network analytics, particularly in Hong Kong, are revolutionizing AML/CFT supervision by improving the detection and prevention of financial crimes. Cyber risk supervision is bolstered by initiatives like ASTERisC* in the Philippines, focusing on enhancing cybersecurity measures. Additionally, climate and ESG risks are being tackled through projects like Singapore’s Project Greenprint, which collects and analyzes ESG data to align business operations with regulatory expectations.

Industries particularly susceptible to these regulatory changes include the financial services sector, which must adopt advanced compliance tools to meet heightened AML/CFT requirements and prudential supervision standards. The technology sector faces increasing pressure to implement secure data protection and cyber risk management systems. Additionally, businesses in sectors with significant environmental impacts, such as manufacturing and energy, are under scrutiny to adhere to stringent climate and ESG regulations, necessitating investments in sustainable practices and compliance reporting.

Challenges Faced by Regulated Entities

Regulated entities are facing significant challenges due to heightened regulatory pressures. Major banks like Citibank exemplify how entities must swiftly adapt to comply with stringent standards. Despite integrating RegTech solutions to enhance compliance efficiency and streamline regulatory reporting processes, Citibank recently faced a $139 million fine for failing to address deficiencies in its risk management and compliance processes. This underscores the critical need for continuous improvement and adaptation.

Effects on Regulated Entities

The adoption of SupTech and the resulting regulatory pressures have substantial effects on the capital expenditures (Capex) of regulated firms. Investment in technology becomes imperative as firms need advanced data management systems and compliance tools to meet new reporting and data collection requirements. There is also a need for specialized skills in data analytics, AI, and machine learning, prompting firms to hire and train staff accordingly. Continuous education programs are essential to keep staff updated with the latest regulatory requirements and technological advancements. Operational costs also rise due to the need for automating compliance processes, integrating new systems with existing infrastructures, and regular maintenance and upgrades of compliance systems.

SupTech Generations

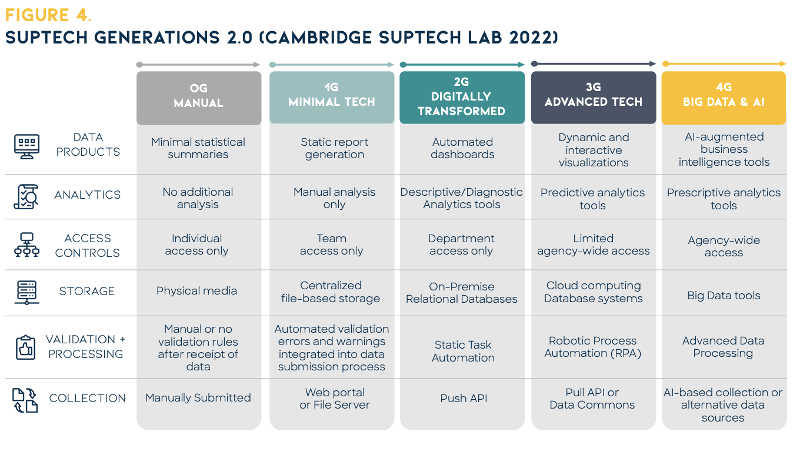

The table below illustrates the evolution of supervisory technology (SupTech) through four generations. It highlights advancements in data products, analytics, access controls, storage, validation, processing, and data collection methods across each generation:

- 0G Manual: Minimal statistical summaries and physical media.

- 1G Minimal Tech: Static report generation.

- 2G Digitally Transformed: Automated dashboards and on-premise relational databases.

- 3G Advanced Tech: Dynamic visualizations and cloud computing.

- 4G Big Data & AI: AI-augmented business intelligence tools and big data storage solutions.

Alignment Between SupTech and RegTech

As regulators increasingly adopt SupTech to enhance their supervisory capabilities, regulated entities are compelled to respond by integrating RegTech solutions into their operations. This shift is not just a regulatory requirement but a strategic necessity to stay compliant and competitive. The timeline of regulatory advancements highlights an undeniable trend towards increasing regulatory pressures. For regulated firms, implementing RegTech solutions is no longer optional but essential.

How Smarbl Can Help

Smarbl offers cutting-edge regulatory technology that empowers regulated firms to thrive under these pressures, transforming compliance challenges into business advantages. With advanced features like monitoring dashboards, automated reporting, dynamic visualizations, and AI-augmented modules, Smarbl streamlines compliance processes, significantly enhancing operational efficiency. The analytics capabilities provide firms with essential predictive and prescriptive tools for proactive regulatory management, enabling quick, informed decision-making to reduce risks and seize new opportunities.

Leveraging Smarbl’s sophisticated technology infrastructure, firms can transform regulatory pressures into business success, driving growth, fostering innovation, and gaining a competitive edge in the market.

Conclusion

As regulatory scrutiny increases, organizations must rethink their data preparation and monitoring strategies. The adoption of SupTech and the resulting regulatory pressures necessitate investments in technology, staff training, and operational upgrades to comply with increasing regulatory demands. However, the long-term advantages, including improved compliance efficiency and risk management, make this investment worthwhile. Embracing SupTech will be crucial for financial institutions to maintain compliance and competitive edge in an evolving regulatory environment.