Data standards are the rulebook of the digital economy. Much like traffic laws regulate vehicles

on busy roads, data standards ensure that information remains consistent, secure, and

interpretable across systems, geographies, and institutions.

In financial services, the importance of standards cannot be overstated. Every day, banks,

insurers, and fintechs process vast amounts of sensitive data on customers, transactions,

exposures, and risks. Even a small gap in accuracy, traceability, or security can lead to severe

consequences — regulatory breaches, financial penalties, reputational damage, or customer trust

erosion.

This article explores the evolution of regulatory data standards, highlights the major global

frameworks such as BCBS 239, GDPR, and PCI-DSS, explains their implications for financial

institutions, and outlines where the industry is heading. Finally, it looks at how Smarbl enables

organizations to stay compliant while making data a driver of strategic value.

Why Regulatory Data Standards Are Essential

Today’s financial institutions operate in a hyper-connected, data-heavy environment. The

growth of digital services has increased both the volume and velocity of data, making

inconsistencies or gaps far riskier than in the past.

Weak or fragmented standards can lead to major risks: misstated exposures during stress testing,

privacy breaches resulting in lawsuits, or regulatory fines for late or inaccurate reporting. Beyond

compliance, inconsistent data erodes internal decision-making, leaving organizations blind to

emerging risks.

By contrast, robust regulatory data standards act as a safeguard. They embed data quality,

governance, and trust into operations, ensuring that information can be aggregated, reported,

and audited with confidence. For modern institutions, standards are not simply about ticking a box

for regulators — they are about enabling resilience, transparency, and competitive

differentiation.

The Evolution of Standards: Regulation Born from Crisis:

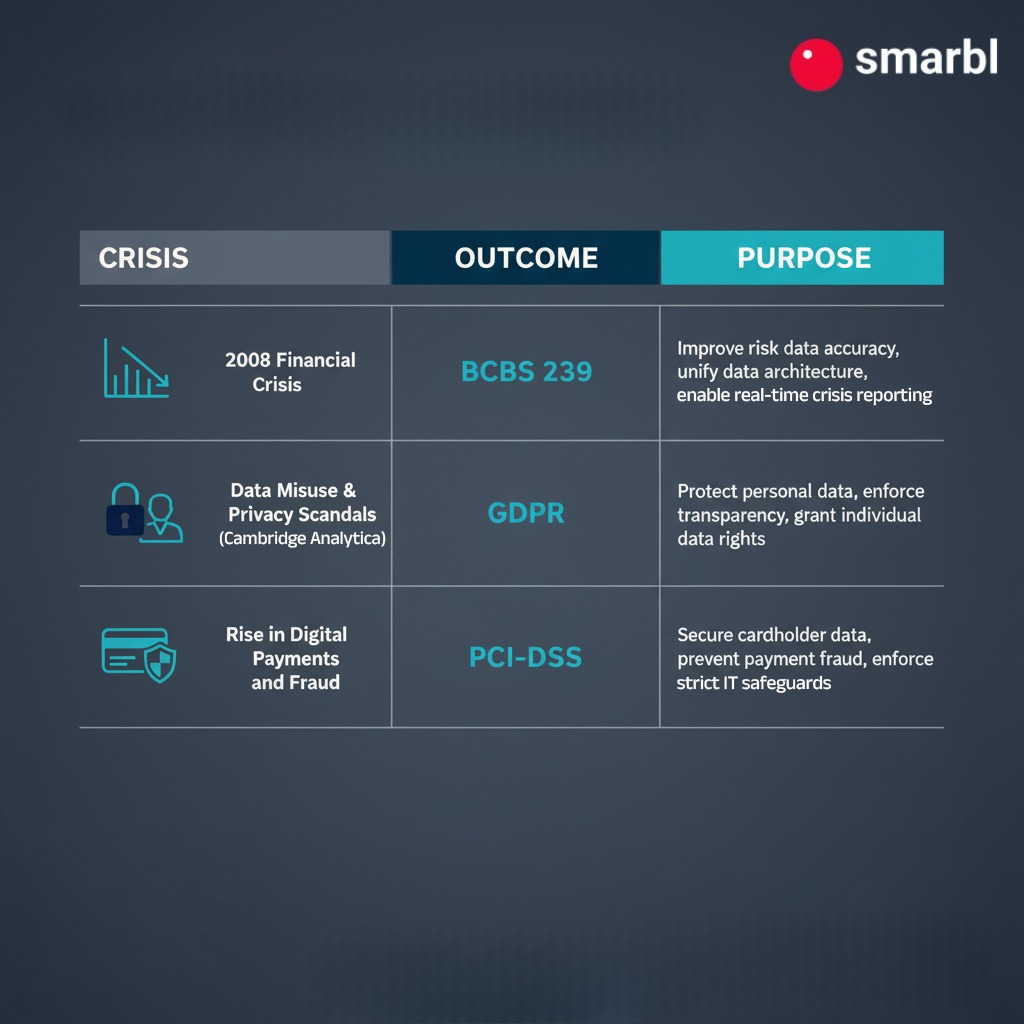

Most major regulatory standards emerged as a direct response to systemic weaknesses or crises.

- The 2008 financial crisis revealed how banks struggled to calculate risk exposure when assets were spread across siloed systems. This failure gave rise to BCBS 239, setting new expectations for risk data aggregation and reporting.

- Years of public anger over personal data misuse, culminating in high-profile scandals like Cambridge Analytica, led Europe to introduce the General Data ProtectionRegulation (GDPR) in 2018.

- The surge in e-commerce and digital transactions, paired with growing payment fraud, pushed card networks to establish the Payment Card Industry Data Security Standard (PCI-DSS), defining how sensitive cardholder data must be protected.

Each of these frameworks demonstrates the same pattern: when gaps in governance, privacy, or security are exposed, regulatory standards emerge to enforce discipline and restore trust.

Spotlight on Major Regulatory Data Standards

BCBS 239 – Risk Data Aggregation and Reporting (RDARR)

The 2008 crisis underscored a critical vulnerability: banks could not accurately measure their exposures in real time. To address this, the Basel Committee on Banking Supervision introduced BCBS 239, a global standard designed to strengthen how banks aggregate, manage, and report risk-related data.

BCBS 239 sets out 14 high-level principles focusing on governance, data architecture, risk aggregation capabilities, and timely reporting. Both Global Systemically Important Banks (G- SIBs) and Domestic Systemically Important Banks (D-SIBs) are expected to comply, with an emphasis on ensuring that risk data is accurate, complete, timely, and accessible — even during a crisis.

In practice, this requires:

- Strong governance frameworks with clearly defined data ownership and stewardship.

- Breaking down silos to move toward unified data architecture

- Investment in IT infrastructure to support real-time aggregation, scenario analysis, and crisis reporting

As financial markets grow more complex and new risks — from cybersecurity to ESG to geopolitics — emerge, BCBS 239 remains a foundational playbook for institutions seeking to be not just compliant, but also resilient and insight-driven.

GDPR – General Data Protection Regulation (EU)

The introduction of GDPR in 2018 marked a turning point in global data protection. Unlike earlier frameworks, GDPR gave individuals explicit rights over their data and placed strict operational obligations on organizations.

Under GDPR, individuals have the right to know what data is collected, to access it, to correct inaccuracies, and even to request deletion. For organizations, this means demonstrating lawful processing, secure storage, and rapid breach reporting within 72 hours.

For financial institutions, the implications are significant. Banks and insurers handle vast quantities of sensitive information — from transaction histories to biometrics. GDPR requires them to implement privacy by design, conduct Data Protection Impact Assessments (DPIAs), and in many cases appoint Data Protection Officers (DPOs). Non-compliance can carry fines of up to €20 million or 4% of global annual revenue, making GDPR one of the most stringent regulatory frameworks in the world.

Beyond compliance, GDPR is a cultural shift. It forces organizations to rethink how they manage data, putting trust and transparency at the center of customer relationships. This shift has inspired similar laws worldwide, from California’s CCPA to India’s DPDP Act.

PCI-DSS – Payment Card Industry Data Security Standard

As digital transactions accelerate, so too does the sophistication of payment fraud. PCI-DSS, developed by major card networks such as Visa, MasterCard, and American Express, is a global standard designed to protect cardholder data across storage, processing, and transmission.

PCI-DSS defines 12 core security requirements ranging from firewall configurations and encryption to access restrictions and routine security testing. While it may appear technical in nature, its purpose goes beyond IT hygiene: PCI-DSS is the baseline for operational credibility in digital payments.

For financial institutions, compliance is non-negotiable. Breaches of cardholder data not only trigger penalties but also erode customer trust, damage reputations, and expose organizations to legal liability. As tokenization, digital wallets, and contactless payments become the norm, PCI-DSS provides the framework that keeps the entire payment ecosystem secure.

What This Means for Financial Institutions

In today’s regulatory climate, compliance with data standards is more than a legal requirement — it is a strategic imperative. Regulators are demanding faster turnaround times, deeper granularity, and complete audit trails. At the same time, customers expect transparency and security.

For financial institutions, this means:

- Establishing robust data governance frameworks with clear roles and responsibilities.

- Prioritizing data lineage and transparency, enabling auditors and regulators to trace the origins and flow of information.

- Moving away from fragmented, legacy systems toward centralized, secure data platforms that are scalable and reporting-ready.

- Embracing automation and machine-readability in reporting, reducing manual reconciliations and increasing efficiency.

- Creating flexible compliance frameworks that align with global regulations while

- adapting to local requirements such as India’s DPDP or China’s PIPL.

Ultimately, the winners will be those institutions that treat compliance not as an obligation but as a driver of efficiency, trust, and competitive advantage.

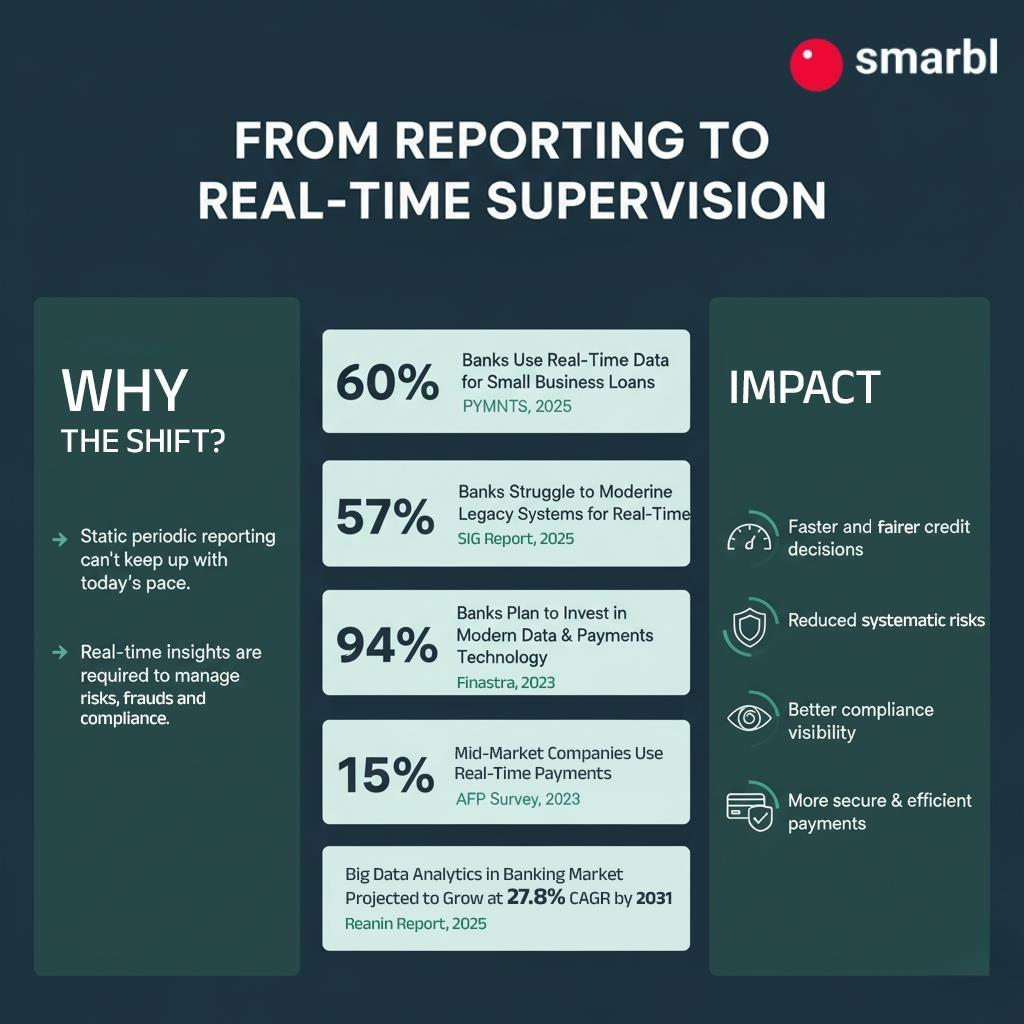

The Way Forward: From Reporting to Real-Time Supervision

The future of regulatory compliance is moving away from static, document-based reporting and toward data-driven supervision. Regulators no longer want just reports — they want access to standardized, validated, and machine-readable data in real time.

Several key trends are shaping the decade ahead:

- A shift from periodic reporting to continuous, real-time oversight.

- Integration of AI and analytics to detect anomalies in data streams.

- Growing global convergence of privacy and reporting regulations.

- Increased cross-border enforcement of compliance obligations.

- Empowerment of consumers through data portability and consent controls

Institutions that adapt early will find themselves better positioned to thrive in a regulatory environment defined by speed, transparency, and accountability.

How Smarbl Helps

At Smarbl, we help financial institutions make regulatory data standards actionable. Our platform is built to embed frameworks like BCBS 239, GDPR, and PCI-DSS directly into day-to- day operations, reducing compliance friction and enhancing data-driven decision-making.

Smarbl provides:

- A data lineage and control framework tailored for regulatory reporting.

- Tools for mapping internal data models to standardized formats.

- Support for compliance with GDPR, DPDP (India), PCI-DSS, and other global regulations.

- Dashboards to monitor data quality, timeliness, and completeness.

- Infrastructure that is future-ready for machine-readable reporting and AI integration

Whether you are a global bank or a fast-scaling fintech, Smarbl empowers you to build compliance frameworks that scale, while ensuring that your data remains an asset for growth and innovation — not just a regulatory burden.

Conclusion

As regulatory demands evolve, one truth remains constant: data is the currency of trust in financial services. Standards such as BCBS 239, GDPR, and PCI-DSS reflect a global shift toward greater accountability, transparency, and resilience. Institutions that view these frameworks merely as obligations will always be on the defensive. Those that embrace them as strategic guardrails will lead the way in building stronger, smarter, and more trusted organizations.

The path forward requires more than compliance checklists — it requires the ability to integrate regulatory standards into the very fabric of data management. That is where Smarbl empowers financial institutions: by transforming regulatory complexity into a structured, sustainable framework for growth, innovation, and trust.